There are many other ways to invest in cryptocurrency outside buying it directly.

Over the decade that I’ve followed BTC, the Grayscale Investment Trust debuted in 2013, Coinbase went public with their IPO earlier this year, and more than 10 Ethereum ETFs are in development.

It’s madness.

Cryptocurrency will be so easy to invest in that your grandma and grandpa will be able to effortlessly own some in their retirement fund.

Recently, however, one of the most popular ways to invest in cryptocurrency is through cryptocurrency mining stocks like Marathon Patent Group, Riot Blockchain and SOS Ltd.

So let’s break down if these investments are worth looking into and if they’ve outperformed buying actual cryptocurrencies on an exchange.

This is What Crypto Mining Stocks Bring to the Table

Crypto mining stocks are shares of Bitcoin mining companies that you can buy and sell on the stock market, just like shares of companies such as Amazon, Google, Tesla or Facebook.

Currently, the most popular crypto mining companies listed on the stock market include Riot Blockchain (RIOT), Marathon Patent (MARA), Bit Digital (BTBT) and SOS.

Don’t get it twisted.

While these companies work in crypto, they do not have any digital tokens.

These are traditional stocks subjected to standard stock market regulations and cannot be purchased on any digital assets exchange, but only through a licensed stockbroker.

In other words, buying stocks of Bitcoin mining companies is no different from buying stocks of companies that mine gold. Instead of buying the final product, you invest in the industry itself. It’s a legitimate way of investment and many people find it to be an attractive option for diversifying their portfolio.

Why Are Crypto Mining Stocks Valuable?

Originally, in the early days of crypto, everyone could mine Bitcoin with their home PC or laptop.

As the BTC network grew, however, the math problems that needed to be solved to mine new blocks became too complex for everyday computers to handle.

Nowadays, mining Bitcoin requires specialized hardware called application-specific integrated circuit (ASIC) miners.

Laymen just call them “mining rigs.”

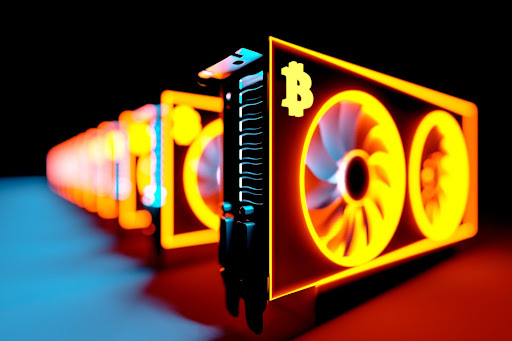

Each mining rig is a computer system with multiple GPUs (graphic cards). Additionally, most mining groups use only the most advanced and latest GPUs on the market, which are very expensive and can be hard to buy.

It’s why those Nvidia 2080s and 3080s GPUs are always out of stock (it’s also why Nvidia’s stock is tied to Bitcoin’s price to some degree and worth looking into).

These crypto mining firms build massive farms which consist of hundreds or thousands of mining rigs.

Mining Bitcoin isn’t just a hobby, it’s a lifestyle. Oh god did I just say that? Well, it is!

Building and maintaining BTC mining farms can be extremely expensive and complicated, but it is also very lucrative. In a way, it’s made the crypto industry oligarchical but that’s a topic for another day.

Why Do People Invest In Crypto Mining Stocks Instead of Bitcoin?

Why would anyone invest in stocks of a crypto mining company rather than simply buying BTC or ETH? There are many reasons why.

For starters, sometimes directly purchasing cryptocurrency is out of the question for legal reasons. While retail investors in most jurisdictions can buy crypto for themselves, the situation is different for big banks, investment companies, insurance firms, hedge funds and so on.

Since crypto is a new industry, many countries lack a legal framework allowing companies to invest in cryptocurrencies in a regulated way. In situations like that, indirect investments in the blockchain ecosystem are the best way to get exposure to the crypto market.

Moreover, many times these stocks are also positioned to outperform Bitcoin. This was the case for RIOT, SOS and MARA earlier this year.

If someone owns both crypto and stocks, owning both BTC and Bitcoin mining companies is an efficient strategy to protect your capital from volatility.

While stocks like RIOT and MARA are directly tied to the price of Bitcoin, they also have their own metrics for success including total BTC mined and eco-friendly production plants.

Keep Your Eye On These Three Stocks

Riot Blockchain (RIOT): Riot Blockchain is the largest publicly listed cryptocurrency mining company in North America, as measured by market cap. It mines Bitcoin and Litecoin. Riot continues to move at a beatnik pace, mining 243 Bitcoin tokens in its New York and Texas mining facilities in June.

Marathon Patent Group (MARA): By the end of 2021, Marathon Patent Group is set to become the largest bitcoin mining company in North America based on its scheduled hashrate capacity. Additionally, to start off 2021 Marathon Patent Group partnered with Canadian blockchain platform company DMG Blockchain Solutions. The partnership formed a mining pool called ‘Digital Currency Miners of North America.’

Bit Digital (BTBT): Bit Digital is a Bitcoin mining company headquartered in New York City with miners located in China, Mongolia, and the United States. Its share price outperformed Bitcoin’s price in every quarter of 2020. Like the other mining companies on this list, BTBT has shifted its focus towards sustainability in Bitcoin mining.

Crypto Mining Stocks Vs. Bitcoin

Following China’s ban on Bitcoin, cryptocurrency mining became a game best played in North America. This is why mining groups in this region are continuing to thrive.

Crypto mining stocks shouldn’t really be considered competition or a replacement to cryptocurrencies themselves; rather, they can be considered a supplementary asset with some important use cases.

For many retail and institutional investors, shares of crypto mining companies are a more convenient and sometimes more lucrative means of getting exposure to crypto.

And for others, crypto mining stocks are an attractive method of diversifying a portfolio and making it more versatile and resilient.

For many experienced crypto investors, owning both Bitcoin and crypto mining stocks is a very reasonable decision.